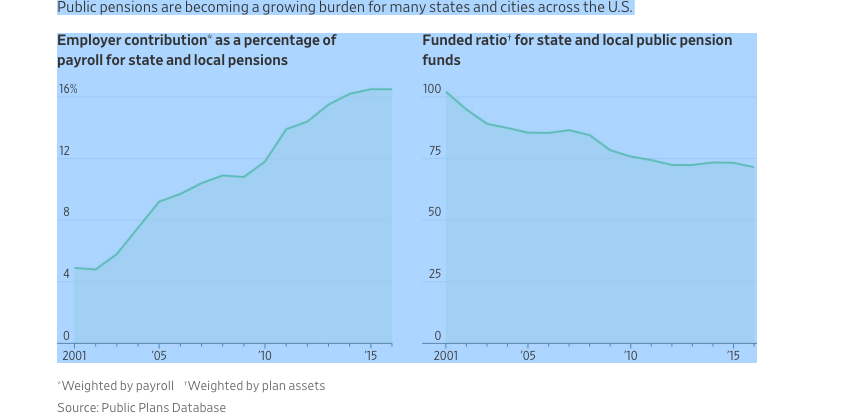

Government workers face reduced or cancelled pensions as cities and states are hit with financial distress and bankruptcy. Government leaders are dealing with the difficult choice of solving the problem one of 3 ways: increase taxes, divert funds from pensions, or persuade workers to relinquish money they are owed. More often than not, it is the workers who must give up their promised retirement salve. State and local pension plans in the U.S. now have less than three-quarters of the money they need to meet their promised payouts, their lowest level since at least 2001. For more advice on protecting your pension in the event of bankruptcy, please feel free to reach out to us. Please also review this article for more detail on this topic.

Read MoreCondominium fees accruing post-bankruptcy must be paid perpetually by a debtor until the condo is sold by the foreclosing lender. A novel court decision has discharged condo fees in a chapter 13 case, based on the absence of the legal language that prohibits such discharge in a chapter 7, 11 or 12 case. This ruling brings hope to financially distressed condo owners who cannot afford to make these payments on a property in which they do not have possession. For additional questions, please feel free to reach out to us, and for a brief review of this issue, please see the following article.

Read MoreFor those seeking a way to have their student debt paid off, you now have the opportunity to participate in a game show that will pay off the student debt of the winner. The founders of this show are seeking to bring awareness to the student debt crisis. For more information, please see the following article.

Read MoreBlockchain is an innovative mechanism that has many societal uses and has already been benefitting private business and government. Supply chain management, Stock issuance, Overseas welfare distribution, Micro-Bond borrowing and more are all made more efficient, secure and trustworthy in execution by this technology. Please see the following article by Kevin Werbach of Wharton’s Legal Studies and Business Ethics Department on the many positive outcomes that we can achieve, while managing any corresponding risks.

Read MorePayment company Square got the green light from regulators Monday allowing New Yorkers to trade cryptocurrency on the rapidly growing Cash app. They had approval in most states but New York was by far the biggest one where you couldn’t trade bitcoin. For more information, please see the attached news release.

Read MoreStates will be able to force more people to pay sales tax when they make online purchases under a Supreme Court decision Thursday that will leave shoppers with lighter wallets. Retail trade groups praised the ruling, saying it levels the playing field for local and online businesses. The losers are online-only retailers, especially smaller ones, who will need to implement mechanisms to comply with various state sales tax laws. For more information on this topic, please see this article.

Read MoreThe constitutional status of the CFPB designed to protect consumers from predatory creditors in the lending and trade credit space has been questioned by a federal district court in New York, despite having been upheld by a federal appellate court in the District of Columbia. As this issue percolates, consumers will find the D.C. courts to be potentially more favorable to their position than those of New York. For additional information, please see a recent article on the topic.

Read More