The Bank Policy Institute and American Bankers Association has filed a petition asking the Trump administration to write a rule stating that bank examiners won’t punish firms for violating informal voluntary policies known as “guidance.” The petition is a gambit in a yearlong fight over guidance documents used by regulators to punish or threaten to punish banks. An FDIC spokesman confirmed that “ supervisory guidance does not have the force or effect of law.” If you have any additional questions, please feel free to reach out, and for more details on this petition, please review the following article.

Read MoreThere is now a growing international trend to impose revenue based taxes on technology giants rather than their profit. The U.K. just announced a 2% tax on revenue. South Korea, India and other Asian-Pacific countries are exploring these taxes, as are Mexico, Chile and Latin American countries. These taxes seek to capture revenue from digital services sold by foreign global companies in a given country. The U.S. is concerned over these tax impositions that are affecting American companies overseas. Please feel free to reach out to us from more information on the effect of these taxes on your business, and see this article.

Read MoreA Denver Bankruptcy Judge, following what she called the “trending narrow view” ruled that an educational loan from a private lender is discharged automatically in bankruptcy, because it does not fit within the governmental educational provision that renders those “benefits” non-dischargeable. For help with discharging your private loans in bankruptcy, please contact us for a free consultation. For more information on this new trend and decision by Bankruptcy Judge Kimberley H. Tyson, please review the following article.

Read MoreIn a case of first impression, a PA court has held that a foreign corporation registered to do business in PA has effectively consented to be sued in the state. This makes perfect sense, as registration in a state is a form of consent to the jurisdiction of its courts and application of its laws. To discuss how you can best tailor your company’s legal aspects to meet your business needs, please feel free to contact us. For more details on the PA court decision, please click here.

Read MoreSenator Elizabeth Warren, a consumer advocate, has proposed a law that would require corporations to be responsible to employees and other stakeholders beyond the mantra of “maximizing returns to shareholders only”. She argues that this law would benefit the holistic ecosystem of the corporate entity, its workers and owners, as well as the overall market. If you are questioning your duty as a business owner or your rights as an employee or independent contractor, please feel free to reach out to us for assistance. For more details on the status of this bill, please review the following article.

Read MoreA recent court decision has found that the buyer of a company can enforce a non-compete violation by the seller that occurs after the seller files for bankruptcy and is also fired by the buyer. The court held that this claim is not discharged in bankruptcy, because it arose after the bankruptcy filing of the seller. The court further held that the claim was not released in bankruptcy due to any arguably automatic rejection of the buy-sell contract, as this contract was fully performed once the buyer fired the seller, thus rendering it not rejectable. For more information on planning the purchase or sale of a business, please feel free to reach out to us. For more detailed information on this court decision, please review the following article.

Read More

The Treasury Department recently released proposals for regulating financial technology that could greatly influence the emerging industry. The recommendations endorse “regulatory sandboxes,” which would allow companies to experiment with new services that push the boundaries of current law. New York’s Department of Financial Services Superintendent Maria Vullo has blasted this charter and the regulatory sandboxes. These proposals seek to eliminate a pay-day lending rule to protect borrowers from illegally high interest rates, as well as eliminate state usury laws in favor of federal law which endorses high rates. We are happy to provide further advice. For the remainder of the report, please review the following article.

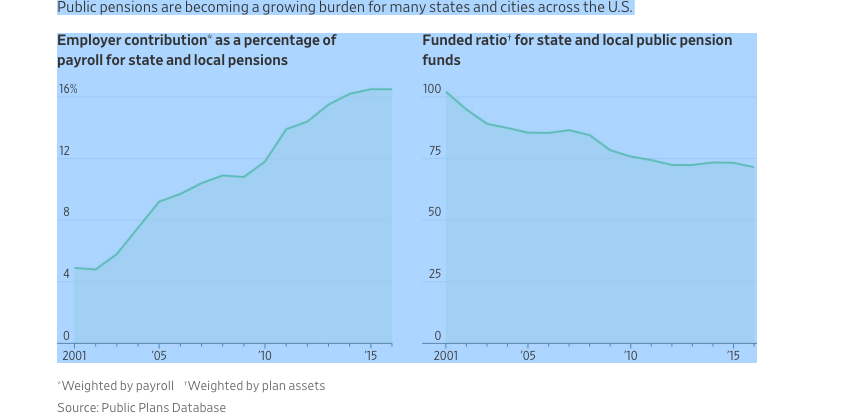

Read MoreGovernment workers face reduced or cancelled pensions as cities and states are hit with financial distress and bankruptcy. Government leaders are dealing with the difficult choice of solving the problem one of 3 ways: increase taxes, divert funds from pensions, or persuade workers to relinquish money they are owed. More often than not, it is the workers who must give up their promised retirement salve. State and local pension plans in the U.S. now have less than three-quarters of the money they need to meet their promised payouts, their lowest level since at least 2001. For more advice on protecting your pension in the event of bankruptcy, please feel free to reach out to us. Please also review this article for more detail on this topic.

Read MoreCondominium fees accruing post-bankruptcy must be paid perpetually by a debtor until the condo is sold by the foreclosing lender. A novel court decision has discharged condo fees in a chapter 13 case, based on the absence of the legal language that prohibits such discharge in a chapter 7, 11 or 12 case. This ruling brings hope to financially distressed condo owners who cannot afford to make these payments on a property in which they do not have possession. For additional questions, please feel free to reach out to us, and for a brief review of this issue, please see the following article.

Read More