Posts Tagged ‘debtor-creditor’

Chapter 15 Filings as Cross-border Connectors

Chapter 15 allows foreign companies to file US bankruptcy proceedings to protect US assets. Over the past year, filings in Canada, Australia and the UK have spilled over to the US. While each country has its own unique set of laws, these cross-border links demonstrate the truly global nature of insolvency and the need to…

Read MoreWill Student Debt become dischargeable?

The saga of student debt continues into the new administration. Here’s to hoping that it will be treated like any other debt in bankruptcy in the future, treating Education Department backed debts like any other unsecured debt, and affording fresh starts to all.

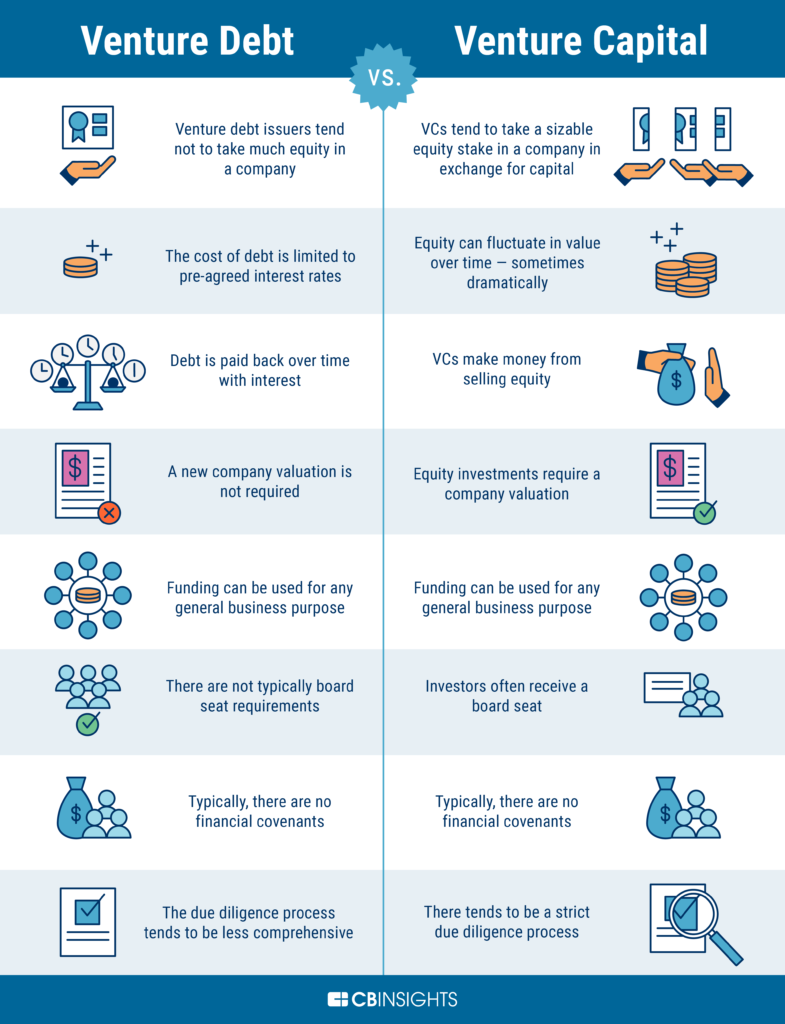

Read MoreVenture Debt is a Growing Option for Start-ups

Venture Debt is a growing option for start-ups to access growth capital, while maintaining founder equity. The terms of Venture Debt include fixed repayment with interest secured by company assets, with a mild equity twist. This is a welcome trend, although piggy-backing on the prior infusion and support of Venture Capital.

Read MoreSEC to Expand Crowdfunding Investment Pool

The SEC recently voted to expand its mission to help small business fundraise in private markets by increasing the threshold crowdfunding amount to $5M and the amounts that the non-accredited can invest. This new access is expected to boost entrepreneurship, now ever more present in our new normal of COVID-19.

Read MoreDebt of Single Asset Real Estate entity blows Subchapter V Eligibility

A recent bankruptcy court decision has found the debt of an affiliate that is ineligible to file for Subchapter V to be included in the $7.5M threshold for eligibility (and post-CARES Act, a $2.7M threshold). In this case, the affiliate was a single asset real estate entity. This decision appears counterintuitive. Stay tuned for an appeal?

Read MoreThe Catch 22 in Crowdfunding Campaigns

A recent study shows that crowdfunding psychology requires a unique fundraising strategy. An abundance of early donations is viewed as originating from friends and family who have not scrutinized the deal, while the opposite is inferred from a lean start. Balancing this perception from day 1 is key to a successful campaign.

Read MorePPP Recipients can Self-Certify for Small Loan Forgiveness

Thankfully, the SBA has issued new guidelines for PPP loan forgiveness with the following changes. Recipients of $50,000 or less can self-certify that the money was used for covered expenses, the new application is one page short, and the requirement to maintain employee and salary numbers has been eliminated. This is a great step toward accomplishment of…

Read MoreSubchapter V allows Cramdown of Collateral Value

In Pearl Resources, another case of first impression under Subchapter V, a Texas court confirmed a cramdown plan with a reduced collateral value. Parsing a mix of traditional and new chapter 11 provisions, the court permitted a $7.4M replacement lien for the original $35M lien, deeming it sufficient to cover the $1.2M claim, and thus freeing up…

Read MoreA defaulted chapter 13 plan can be extended under the CARES Act

Good news! A New Orleans judge has found the CARES Act to permit a 7 year extension of a chapter 13 plan whose payments were in default prior to enactment of the Act, holding that the currency of payments is irrelevant. In fact, most chapter 13 plans are in a state of default and ultimately…

Read MoreStakeholders anxiously await clarification of PPP loan forgiveness process

Borrowers and lenders are being advised to sit tight, while Congress reworks the kinks toward debt forgiveness for PPP loans. As outlined by the NYT, progress is being made toward overcoming the various hurdles so that all stakeholders will be able to achieve the initiative’s well-intended respite and fresh start.

Read More