Posts Tagged ‘carolyn hochstadter dicker’

Loved Participating on this Panel on Redesigning Medical Entrepreneurship

Thanks to my co-panelists for a great discussion on Redesigning Medical Entrepreneurship in the Global space! And thanks to Sheba Medical Center for hosting an amazing ARC Summit to foster innovation in the digital health and biotech space around the world. Looking forward to continuing the discussion!

Read MoreEnjoyed talking about AI in the IP and FDA spaces with Sheba’s SPARC ventures!

Mazal Tov to the amazing and innovative digital health entrepreneurs at Sheba Medical Center that just graduated from the SPARC bootcamp. I really enjoyed talking with them about how to plan their AI ventures and navigate their IP and FDA planning. Looking forward to staying in touch!

Read MoreFor Digital Health Entrepreneurs or Advisors: Planning your First Critical Steps

Please join me at Jenkins Law Library for a virtual CLE discussion on the key issues to take into account as you plan and build your digital health startup. Registration is at the following link: https://www.jenkinslaw.org/cle/classes/building-digital-health-start-what-are-5-critical-concerns-webinar.

Read MorePlease Join a Great Cohort of Women-Owned Start-ups to Discuss Building your Business

Please join me and my sister-owned start-ups, as we navigate the Legal Basics for Starting a Business on February 17, as part of WBEC-East’s Jumpstart-Business Launch. Registration is at the following link: https://wbeceast.com/events/

Read MoreEstablishing a U.S. Entity – A Primer for Israeli Digital Health Start-Ups

Had a fabulous experience serving as faculty on the topic of Establishing a U.S. Entity for Tel Aviv University’s annual 4-day bootcamp, Health Care Technological Innovation – From Idea to Commercialization, hosted by the Lahav Executive Program for Biotechnology, Medical Device and Health IT Entrepreneurs and Managers at the Coller School of Management. This unique intensive program focuses…

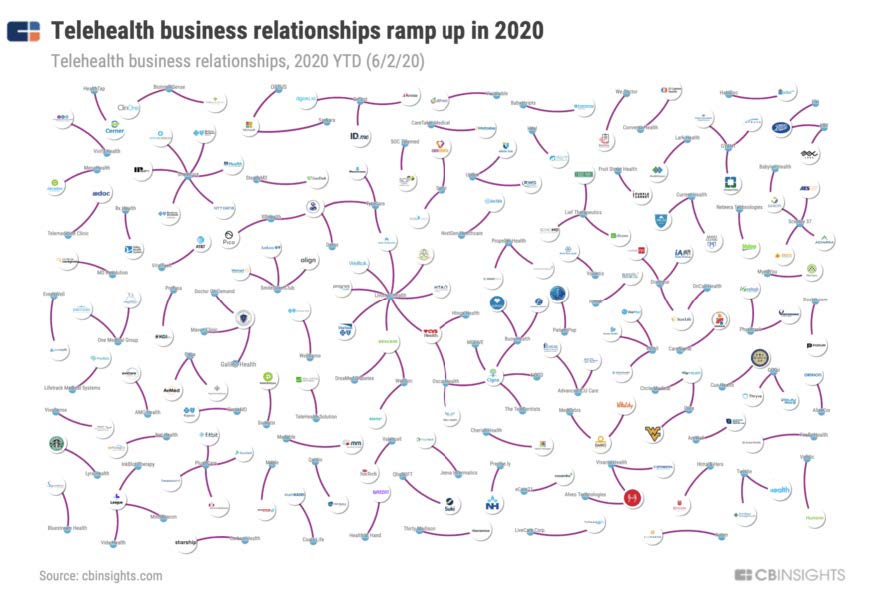

Read MoreOpening The Digital Front Door in Telehealth

The “Digital Front Door” is a new integrated digital experience that empowers people to take an active role in managing their health. It is based on the use of personalized mobile and web platforms, many of them created by start-ups. Spurred by COVID-19, established healthcare systems have forged relationships with these start-ups, opening the door to enhanced care.

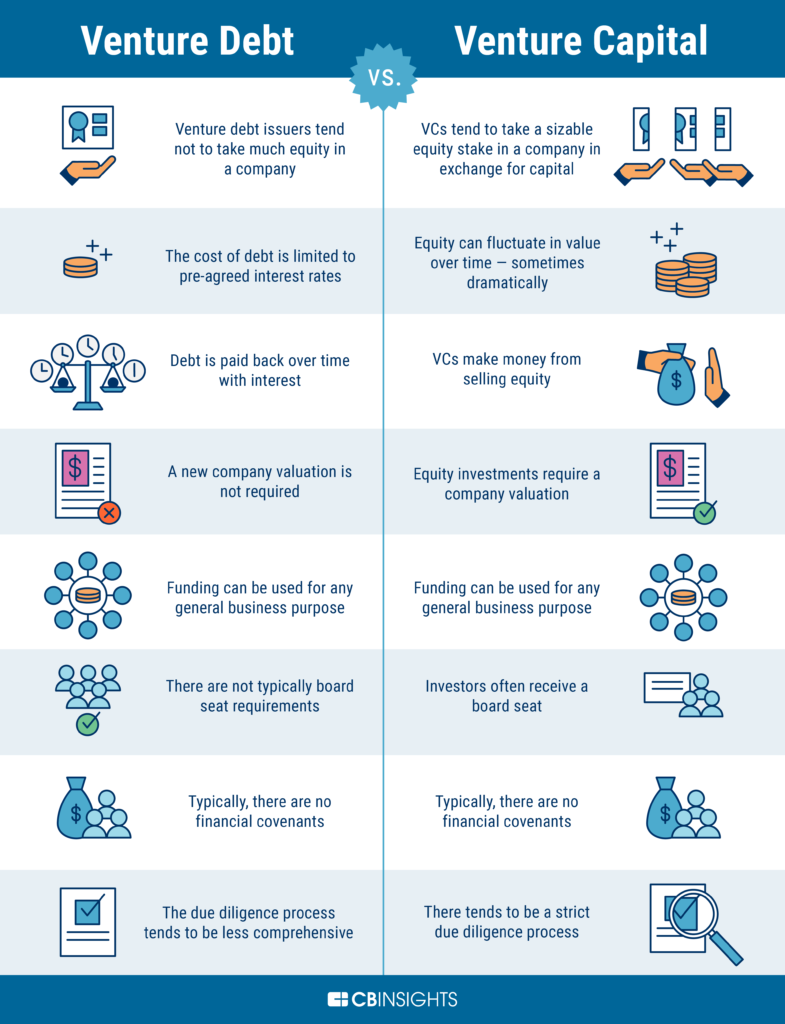

Read MoreVenture Debt is a Growing Option for Start-ups

Venture Debt is a growing option for start-ups to access growth capital, while maintaining founder equity. The terms of Venture Debt include fixed repayment with interest secured by company assets, with a mild equity twist. This is a welcome trend, although piggy-backing on the prior infusion and support of Venture Capital.

Read MoreHybrid Independent Contractor Model Emerges

Uber, Lyft and DoorDash have successfully obtained the CA vote to retain their workers as independent contractors, but they conceded to providing some “employee” benefits to obtain this milestone vote. This may be the beginning of a new model for independent contractor talent hiring in the growing gig ecosystem.

Read MoreSEC to Expand Crowdfunding Investment Pool

The SEC recently voted to expand its mission to help small business fundraise in private markets by increasing the threshold crowdfunding amount to $5M and the amounts that the non-accredited can invest. This new access is expected to boost entrepreneurship, now ever more present in our new normal of COVID-19.

Read MoreDebt of Single Asset Real Estate entity blows Subchapter V Eligibility

A recent bankruptcy court decision has found the debt of an affiliate that is ineligible to file for Subchapter V to be included in the $7.5M threshold for eligibility (and post-CARES Act, a $2.7M threshold). In this case, the affiliate was a single asset real estate entity. This decision appears counterintuitive. Stay tuned for an appeal?

Read More