What’s New in Debtor-Creditor?

Chapter 7 debtor dissolved under State law held responsible for ERISA plan

A company liquidated in bankruptcy and dissolved under state law maintains responsibility for an ERISA plan if it continues to make pay-outs in the company name The 11th Circuit has interpreted ERISA to require such defunct company’s affiliates to back-stop such plan. A timely PBGC take-over would have mitigated this result.

Read MoreWill Student Debt become dischargeable?

The saga of student debt continues into the new administration. Here’s to hoping that it will be treated like any other debt in bankruptcy in the future, treating Education Department backed debts like any other unsecured debt, and affording fresh starts to all.

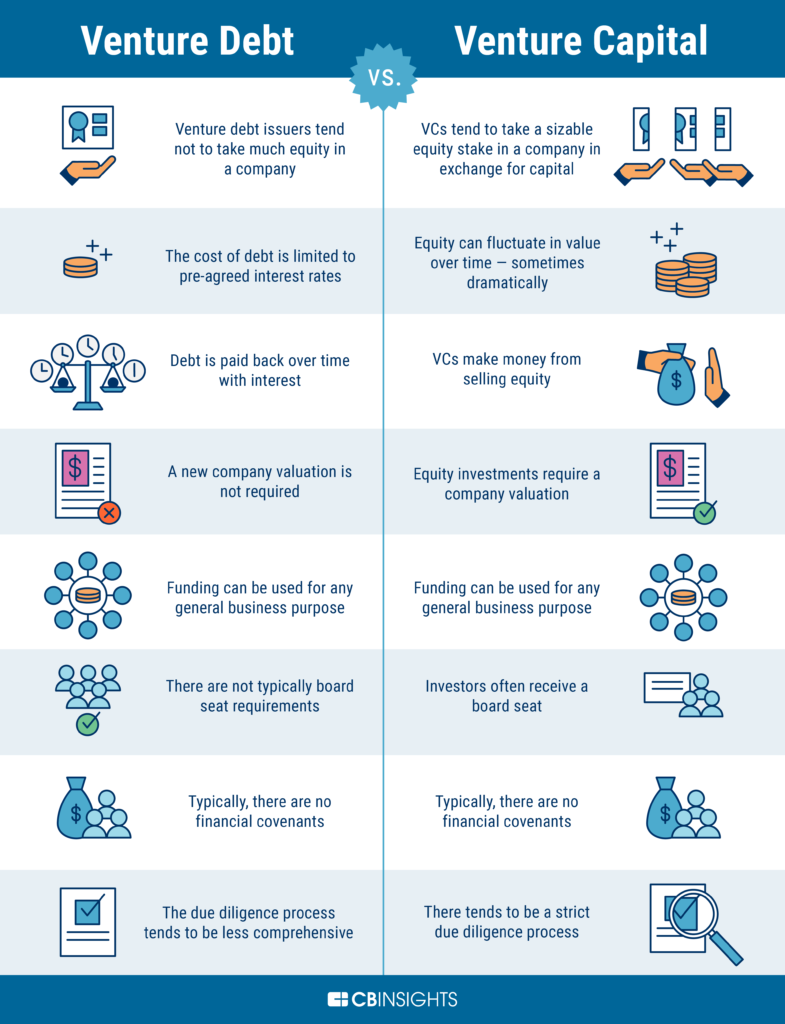

Read MoreVenture Debt is a Growing Option for Start-ups

Venture Debt is a growing option for start-ups to access growth capital, while maintaining founder equity. The terms of Venture Debt include fixed repayment with interest secured by company assets, with a mild equity twist. This is a welcome trend, although piggy-backing on the prior infusion and support of Venture Capital.

Read MoreSEC to Expand Crowdfunding Investment Pool

The SEC recently voted to expand its mission to help small business fundraise in private markets by increasing the threshold crowdfunding amount to $5M and the amounts that the non-accredited can invest. This new access is expected to boost entrepreneurship, now ever more present in our new normal of COVID-19.

Read MoreDebt of Single Asset Real Estate entity blows Subchapter V Eligibility

A recent bankruptcy court decision has found the debt of an affiliate that is ineligible to file for Subchapter V to be included in the $7.5M threshold for eligibility (and post-CARES Act, a $2.7M threshold). In this case, the affiliate was a single asset real estate entity. This decision appears counterintuitive. Stay tuned for an appeal?

Read MorePPP Recipients can Self-Certify for Small Loan Forgiveness

Thankfully, the SBA has issued new guidelines for PPP loan forgiveness with the following changes. Recipients of $50,000 or less can self-certify that the money was used for covered expenses, the new application is one page short, and the requirement to maintain employee and salary numbers has been eliminated. This is a great step toward accomplishment of…

Read MoreTitle VII Loophole Allowing Bank Discrimination May be Soon be Closed

As our country reconciles inequity in the law, The Fair Access to Financial Services Act, introduced last week, prohibits discrimination by banks, closing a gaping loophole. Title VII subjects only certain businesses to its prohibitions, such as movie theaters, restaurants and hotels, allowing banks to treat customers differently. While many states prohibit bank discrimination, the disparity necessitates…

Read MoreSubchapter V has become a cost-effective bankruptcy lifeline for a business reboot

A group of mid-western businesses comment on their unique ability to reorganize under Subchapter V of the Bankruptcy Code in accordance with its intended goal to allow small business owners to retain control of a reorganizing company. Drafters of the new law effected much needed tweaks to the chapter 11 process, an endeavor that has proved to…

Read MoreAn Individual Chapter 11 Plan must be funded by more than Business Income

In re Patel, a recent CA bankruptcy decision, held that chapter 11’s requirement for individual debtors to pay unsecured creditors from “disposable income,” encompasses income from all sources. Note that this would equally apply in Subchapter V. The Patel Chapter 11 plan listed only motel income which was insufficient to fund a payout to unsecured creditors. While…

Read MoreA defaulted chapter 13 plan can be extended under the CARES Act

Good news! A New Orleans judge has found the CARES Act to permit a 7 year extension of a chapter 13 plan whose payments were in default prior to enactment of the Act, holding that the currency of payments is irrelevant. In fact, most chapter 13 plans are in a state of default and ultimately…

Read More