The saga of student debt continues into the new administration. Here’s to hoping that it will be treated like any other debt in bankruptcy in the future, treating Education Department backed debts like any other unsecured debt, and affording fresh starts to all.

Read MoreThe concept of “Comparable Worth” as a way to equalize gender pay under Title VII has been discarded by US courts as too murky to implement. Meanwhile, in New Zealand, a woman-led government is finally making it law. It is about time that so-called “women’s work” is recognized and compensated for its skillful value-add.

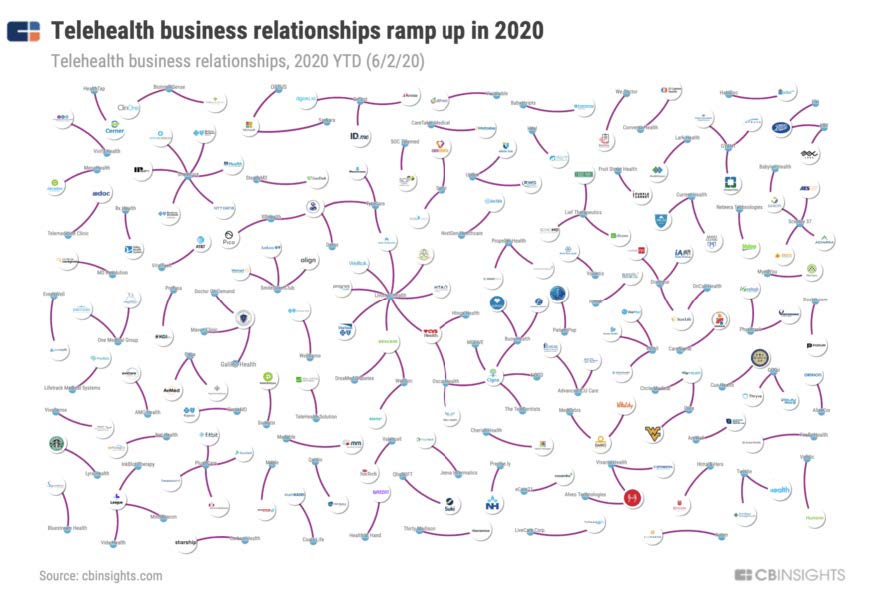

Read MoreThe “Digital Front Door” is a new integrated digital experience that empowers people to take an active role in managing their health. It is based on the use of personalized mobile and web platforms, many of them created by start-ups. Spurred by COVID-19, established healthcare systems have forged relationships with these start-ups, opening the door to enhanced care.

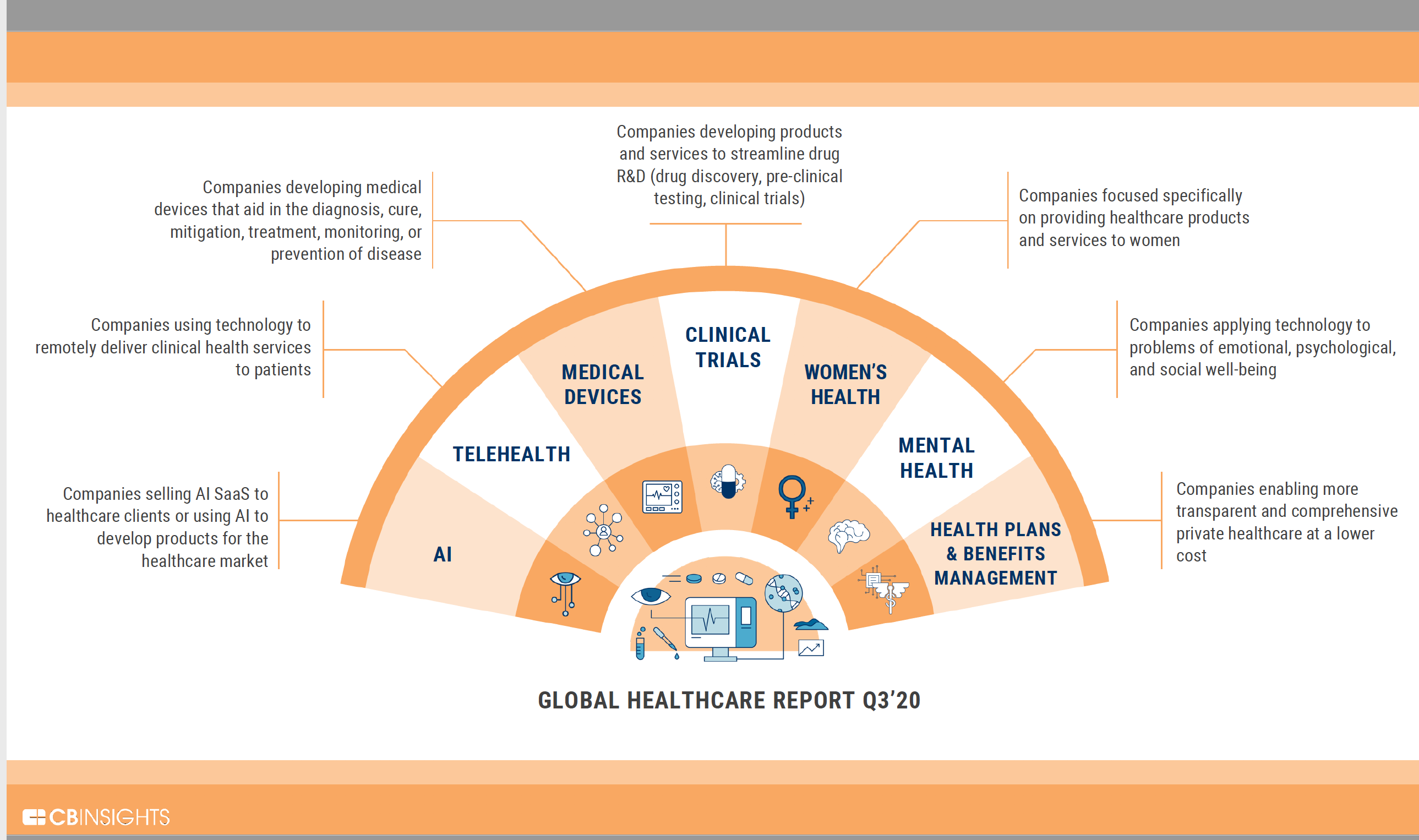

Read MoreFor those interested in a comprehensive yet concise survey of the various digital health sectors, unicorns, investors, trends and more, check out CB Insight’s State of Healthcare Q3’20 Report. Lots of infographics and charts, and lots of promising up and coming companies, including a focus on Women’s Health.

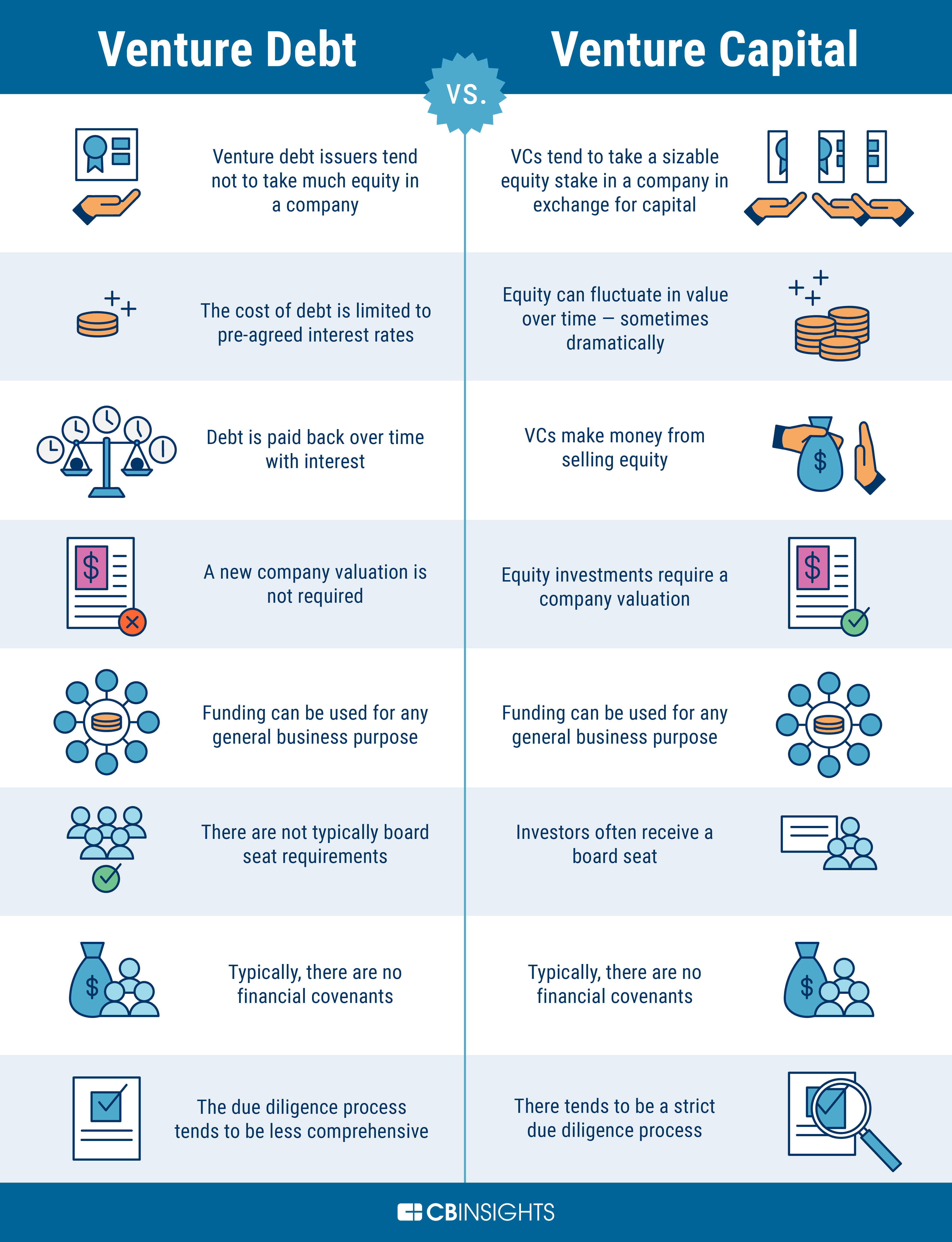

Read MoreVenture Debt is a growing option for start-ups to access growth capital, while maintaining founder equity. The terms of Venture Debt include fixed repayment with interest secured by company assets, with a mild equity twist. This is a welcome trend, although piggy-backing on the prior infusion and support of Venture Capital.

Read More

Uber, Lyft and DoorDash have successfully obtained the CA vote to retain their workers as independent contractors, but they conceded to providing some “employee” benefits to obtain this milestone vote. This may be the beginning of a new model for independent contractor talent hiring in the growing gig ecosystem.

Read More

The SEC recently voted to expand its mission to help small business fundraise in private markets by increasing the threshold crowdfunding amount to $5M and the amounts that the non-accredited can invest. This new access is expected to boost entrepreneurship, now ever more present in our new normal of COVID-19.

Read More

A recent bankruptcy court decision has found the debt of an affiliate that is ineligible to file for Subchapter V to be included in the $7.5M threshold for eligibility (and post-CARES Act, a $2.7M threshold). In this case, the affiliate was a single asset real estate entity. This decision appears counterintuitive. Stay tuned for an appeal?

Read More

A recent study shows that crowdfunding psychology requires a unique fundraising strategy. An abundance of early donations is viewed as originating from friends and family who have not scrutinized the deal, while the opposite is inferred from a lean start. Balancing this perception from day 1 is key to a successful campaign.

Read More